THE South African Post Office (Sapo) faces the potential danger of collapse within a month if it does not secure funding, CEO Mark Barnes said on Friday.

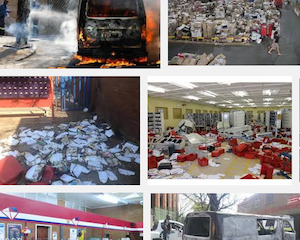

Revenue was under pressure and the company was suffering a loss of about R125m a month, he told MPs in a briefing to the portfolio committee on telecommunications and postal services on Friday. He said twenty-five post offices had closed down.

If Sapo did not pay its creditors within the next few weeks, its very existence would be under threat.

A lot of branches had had to close because of the nonpayment of rent.

Sapo received a R650m cash injection from the state in the budget but this was not enough to eliminate its mountain of debt, which amounted to more than R800m in March.

Mr Barnes said having a government guarantee was no longer sufficient to persuade banks to lend Sapo money. They wanted proof of future revenue streams to repay the debt.

Sapo chairman Simo Lushaba also remarked on the organisation’s attempts to raise cash to dig Sapo out of the hole it is in. Each month that the problem was not solved the hole got bigger, he said.

“We are in the hands of the banks,” he said.

Sapo was struggling to find adequate funding, despite its government guarantees.

Mr Barnes stressed that Postbank was unaffected by Sapo’s financial malaise as it was an entirely separate enterprise.

Mr Barnes said Sapo was expected to make a loss of R1.2bn in the 2015-16 financial year, which would add to last year’s R1.5bn loss. A loss of R1.1bn is forecast for 2016-17 financial year and a net profit in the following year.

However, Sapo is three months behind in its strategy to achieve these financial outcomes.

Every month delay in paying creditors made it increasingly difficult to continue operations and negotiate commercial contracts on favourable terms as there was a lack of trust on the part of suppliers in Sapo.

Mr Barnes said Sapo expected to receive the R650m cash injection from the state on Monday. It has already borrowed against this sum.

He said the Treasury had agreed to extend the term of Sapo’s existing R2.7bn guarantee.

Sapo had managed to get loan commitments of R1.8bn from the banks but needed another R900m if it wanted to get out of its hole. The entire R2.7bn was required as it was not possible to get only partly out of a hole.

Mr Barnes was very critical of banks that were no longer willing to accept government guarantees. They should on this basis no longer accept government deposits, he said.

A key feature of Sapo’s future growth strategy is to be the major distributor of government services such as social grants and to recapture a share of the parcel delivery business.

The entire property strategy is under review.

Postbank has deposits of R7.3bn.

http://www.bdlive.co.za/national/2016/04/15/post-office-in-danger-of-collapse-if-it-cannot-secure-funding