Staff Writer24 June 2020

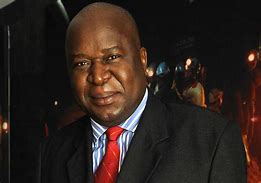

While South Africa has a number of strengths which will help it get through turbulent times, its greatest weakness remains its high level of debt, says finance minister Tito Mboweni.

In his supplementary budget speech on Wednesday (26 June), Mboweni said that the country has accumulated far too much debt and that this downturn will add more. “Debt is our weakness,” he said.

“This year, out of every rand that we pay in tax, 21 cents goes to paying the interest on our past debts.

“This indebtedness condemns us to ever-higher interest rates. If we reduce debt, we will reduce interest rates for everyone and we will unleash investment and growth.”

“So today, with an eye on the future, we set out a strategy to build a bridge to recovery. Our Herculean task is to close the mouth of the Hippopotamus. It is eating our children’s inheritance. We need to stop it now. Our Herculean task is to stabilise debt.”

Mboweni said that early projections show that gross national debt will be close to R4 trillion, or 81.8% of GDP by the end of this fiscal year. This is compared to an estimate of R3.56 trillion or 65.6% of GDP projected in February.

He added that without external support, these borrowings will almost entirely consume all of the country’s annual domestic savings, leaving no scope for investment or borrowing by anyone else.

To help address this shortfall, Mboweni said that government intends to borrow about $7 billion from international finance institutions to support the pandemic response.

“We must make no mistake, these are still borrowings. They are not a source of revenue. They must be paid back,” he said.

Tax increases

While no major tax increases were directly announced by Mboweni, Treasury’s supplementary budget shows that the country will face future tax increases to meet this shortfall.

It further noted that following five years of large tax increases, the 2020 Budget did not propose new tax measures.

“Given the extent of fiscal consolidation now required, however, both expenditure reductions and tax increases are necessary to stabilise debt.

“The active scenario assumes tax increases of R5 billion in 2021/22, R10 billion in 2022/23, R10 billion in 2023/24 and R15 billion in 2024/25.”

Treasury said that the 2020 MTBPS (expected in October) will revisit these projections, and the minister of finance will announce tax policy proposals in the February 2021 Budget.

Zero‐based budgeting

The Medium Term Expenditure Framework process will be guided by the principles of zero‐based budgeting which will be applied as a series of overlapping evaluation exercises targeted at large programmes, Mboweni said.

“Our current system of Public Expenditure Reviews is a step towards zero based budgeting. This means that we will try to reduce all expenditure that we thought we can nolonger afford. After all, we are not as rich as we were ten years ago,” the minister said.

The upcoming MTEF will pilot this approach.

“We need to find spending adjustments of about R230 billion over the next two years. Tax measures of R40 billion over the next 4 years will also be required.”

The Government will announce details to these tax proposals in the 2021 Budget, Mboweni said.

Tax collection hit

The supplementary budget shows that the effect of multiple Covid-19-related shocks on revenue collection is expected to exceed that of the global financial crisis of 2008/09.

Treasury said that the current crisis particularly affects the largest tax bases:

- Personal income taxes are under significant pressure resulting from job losses, labour unavailability and employers’ inability to pay full salaries. Salaries and wages will remain volatile through the recovery period.

- Corporate tax collections will be negatively affected by service and production closures during the lockdown, uncertainty concerning the pace at which normal activity can resume, and weak business and consumer sentiment. Companies of all sizes will be affected.

- Value-added tax (VAT) and customs revenue estimates have been revised down in response to lower confidence, lockdown-related sales restrictions and a much weaker trade outlook.

Treasury added that the short-term impact of the pandemic is evident in the sharp reductions in collections for South Africa’s two largest revenue items – domestic VAT and pay-as-you-earn – in April and May of this year.

Despite these concerns, Treasury said that ‘as growth recovers, so will tax receipts’ .

“Corporate income taxes are highly volatile during and after economic shocks, with sharp contractions as lower profits and assessed losses reduce tax payments over several years, followed by a rebound as profits become taxable.

“As employment and salaries normalise, personal income taxes should be augmented by higher effective tax rates, while recovering consumer demand and investment will bolster VAT and import duties,” it said.

Read: This is the average take-home pay in South Africa right now